According to calculations by the International Energy Agency, global oil consumption is expected to peak around 2030. Major oil-rich states like the United Arab Emirates and Saudi Arabia are looking to diversify their economies into other industries, focusing on the opportunities presented by technology and the financial sector.

Arab Monarchies Planning for a Post-Oil Future

The International Energy Agency (IEA) forecasts that global oil consumption will peak around 2030. The oil-rich Arab monarchies in the Persian Gulf region have realized the need to diversify their revenues to avoid being left behind as the world transitions away from oil and to ensure they do not lose their main source of income in the future due to depleting oil reserves and global green energy initiatives.

These countries are gradually developing sectors beyond finance and business into technology and tourism to reduce their dependence on oil and achieve global standards and increase their regional influence.

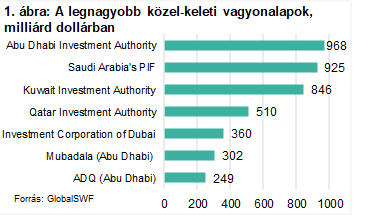

Two leading economic powers in the region, the United Arab Emirates (UAE) and Saudi Arabia, are leading the diversification process. They have substantial financial capital, with their sovereign wealth funds collectively managing over $2 trillion, covering half of the total amount managed by all Middle Eastern wealth funds (Figure 1). To ensure long-term economic growth, both countries are turning towards knowledge-based economies, with a focus on the technology sector, especially semiconductors and artificial intelligence (AI). As a result, the fDi Markets reported growth in incoming technology FDI projects between 2022 and 2023 in the Middle East, while there was a 40% decline globally during the same period.

Saudi Arabia Aims to Become the Leading Tech Power in the Region

Riyadh recently announced a new semiconductor strategy to develop Saudi Arabia into a chip powerhouse. The goal is to attract 50 chip design companies to the country by the end of the decade. Initially focusing on everyday, simpler chip designs rather than competing with top technology providers like Nvidia or Intel. To attract companies and establish their own, the Saudi state plans to provide financial support, training opportunities, and other incentives. However, Riyadh’s long-term strategy is to become a leading technology power in the region. This will require the establishment of national AI companies, data center networks to support them, and onshore chip manufacturing. Expertise could primarily be sourced from China or the United States.

The Monontent that the area’s economy will reach $780 billion by 2030 at a 20% annual growth rate from $180 billion in 2022.

The Arab Monarchies of the Gulf, but particularly the Emirates, are increasingly seen as safe havens for the wealthy to invest their money due to their stability, flexibility, and business-friendly policies. Dubai, in particular, is aiming to become one of the top global financial centers, leveraging its strategic geopolitical location and fostering trust in the global financial system through pragmatic foreign policy.

![The Gulf Coast monarchies prepare for a post-oil world. [object Object]](https://protectedsociety.com/wp-content/uploads/2024/08/The-Gulf-Coast-monarchies-prepare-for-a-post-oil-world-1170x613.jpg)